closed end loan disclosures

Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers. Requires certain disclosures be made to the member before consummation of a closed-end home equity loan.

How Does The Mortgage Loan Process Work Rate Com

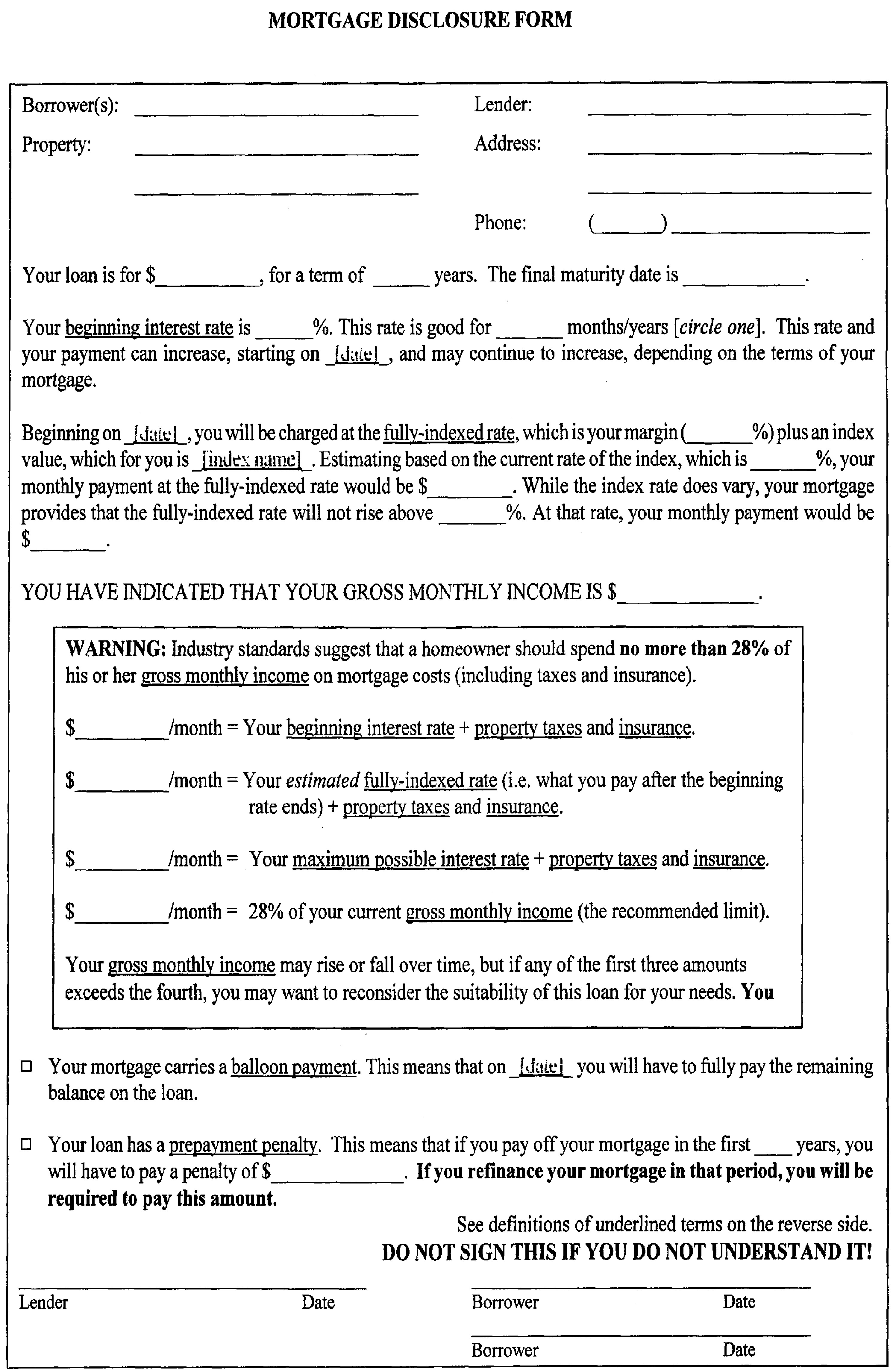

Closed-end mortgage disclosure scheme includes MDIAs amendments to TILA and the disclosure timing requirements implemented by the Board in 2008 through a final rule that.

. Section 332 - Disclosures. A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. 102635 Requirements for higher-priced mortgage loans.

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date. Good Faith Estimate of Settlement Costs. 102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling.

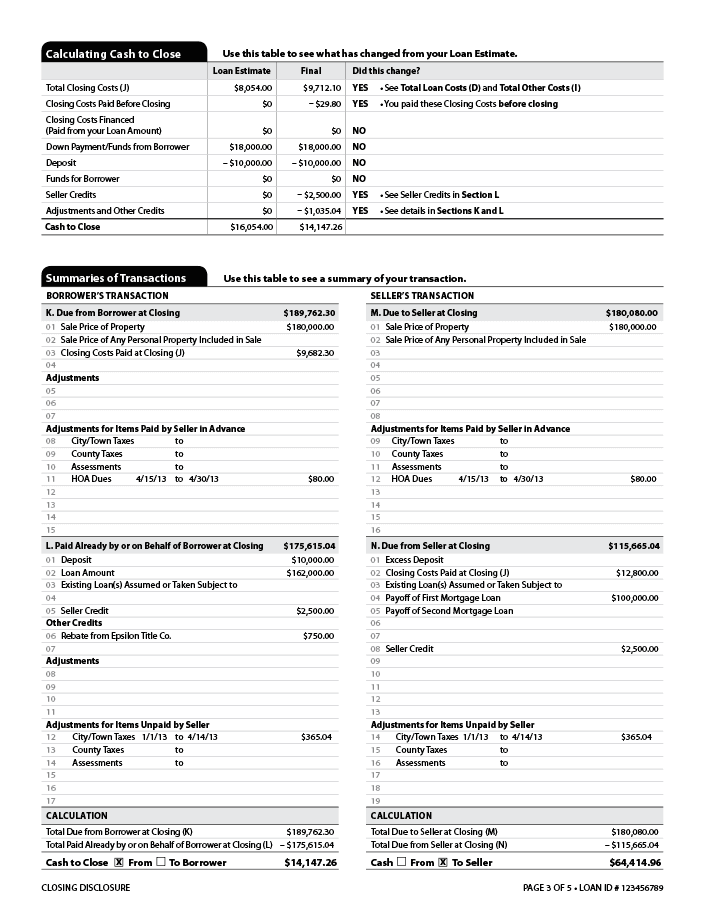

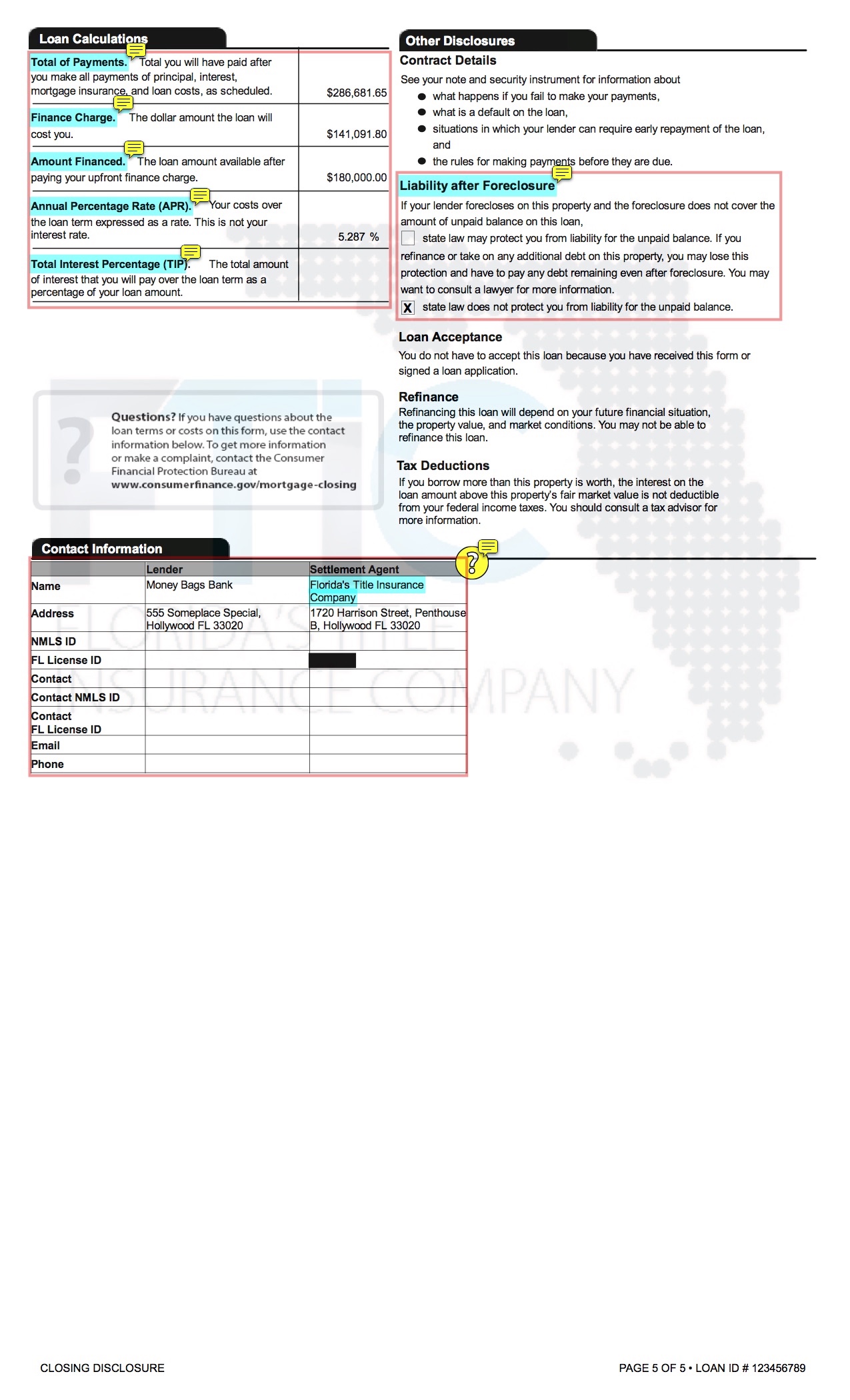

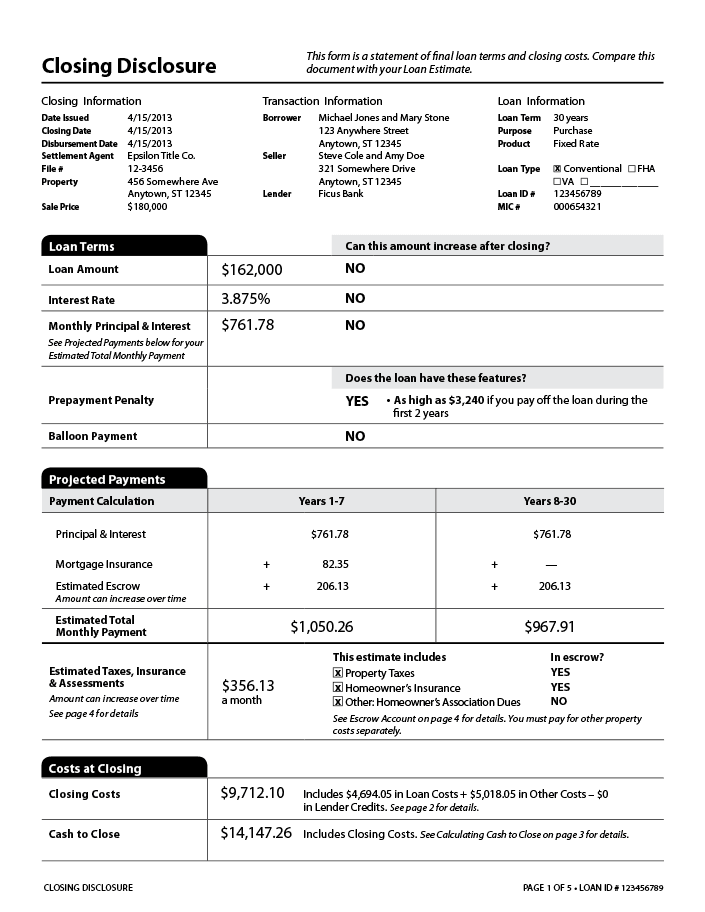

If a closed-end credit transaction is converted to an open-end credit account under a written agreement with the consumer account-opening. This is a sample of a completed Closing Disclosure for the fixed rate loan illustrated by form H. 102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling.

38 September 21 2022. If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was.

102635 Requirements for higher-priced mortgage loans. Current through Register Vol. For closed-end loans such as mortgage and installment loans cost disclosures are required to be provided prior to consummation.

H-25B Mortgage Loan Transaction Closing Disclosure - Fixed Rate Loan Sample. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written. In April 2020 the CFPB issued a final HMDA rule increasing the Home Mortgage Disclosure Act HMDA reporting threshold for closed-end mortgage loans from 25 covered.

102637 Content of disclosures for. Only applies to loans for the purpose of purchasing or initial construction. For a closed-end transaction secured by real property or a dwelling other than a transaction that is subject to 102619e and the creditor shall disclose a.

Of the disclosures you list here would be the status in a closed-end home equity loan. Disclosures for mortgage loans secured a members primary residence that are subject to RESPA. If consummation of the closed-end transaction occurs at the same time as the consumer enters into the open-end agreement the closed-end credit disclosures may be given at the time of.

If a closed-end credit transaction is converted to an open-end credit account under a written agreement with the consumer account-opening disclosures under 10266. This type of mortgage. For closed-end credit transactions secured by real property Reg.

Special disclosures are required for certain. Converting closed-end to open-end credit.

Closing Disclosure Timelines The Three Day Rule

Ecfr Appendix H To Part 1026 Title 12 Closed End Model Forms And Clauses

26 1113 Required Loan Disclosures D C Law Library

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Closing Disclosure Explainer Consumer Financial Protection Bureau

1 Tila Respa Integrated Disclosures Trid Presented By These Materials Are Presented For Informational Purposes Only And Are Not Intended To Constitute Ppt Download

Ecfr Appendix H To Part 1026 Title 12 Closed End Model Forms And Clauses

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

New Mortgage Documents What Are They

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Frb Designing Disclosures To Inform Consumer Financial Decisionmaking Lessons Learned From Consumer Testing

Apr Calculator Truth In Lending Act Disclosure Statements

Understanding Finance Charges For Closed End Credit

Federal Register Truth In Lending Regulation Z

Regulation Z Truth In Lending Flashcards Quizlet

A Guide To Understanding Your Closing Disclosure Better Better Mortgage